Financial Resilience for Businesswomen: A Guide To Handling Loan Repayment Challenges

In 2023, the financial landscape presents a unique array of challenges, especially for businesswomen managing loan repayments.

In 2023, the financial landscape presents a unique array of challenges, especially for businesswomen managing loan repayments.

Amidst the shifting economic conditions, characterized by variable interest rates and evolving banking regulations, the need for astute financial planning and adaptability is more crucial than ever.

This context demands a focused approach for women entrepreneurs, equipping them with essential knowledge and strategies to overcome loan repayment obstacles.

With an emphasis on sustainable business growth and stability, the aim is to fortify their financial resilience in an ever-changing economic environment.

Financial Advice for Navigating Loan Repayment

In 2023, the world of finance is more complex than ever. Businesswomen face unique challenges in loan management due to recent economic shifts.

Effective financial advice is not just about finding the right loan options; it's about strategic planning and adapting to changing market conditions.

This section outlines critical financial advice for businesswomen, focusing on understanding the current financial climate, exploring various financing options, and applying strategic financial management.

Payday Loans: What You Need to Know

Payday Loans: What You Need to Know

Payday loans are often seen as a quick solution for immediate financial needs. However, they come with certain pitfalls that can trap borrowers in a cycle of debt.

High interest rates and short repayment periods are typical features of these loans, making them a risky choice for long-term financial stability.

Businesswomen should be aware of these risks and consider more sustainable funding sources.

It’s crucial to understand the full implications of payday loans and explore safer alternatives that align with long-term financial goals.

Understanding SBA Loans and Other Funding Options

The Small Business Administration (SBA) offers various loan programs tailored to different business needs, including the popular 7(a) loan for working capital, refinancing debt, and purchasing business essentials.

Other options like SBA Express Loans and Community Advantage Loans provide targeted support for specific needs.

Exploring bank loans, alternative online lenders, and crowdfunding platforms can offer alternative routes to financing.

These options cater to the diverse needs of women entrepreneurs, providing them with the necessary capital to grow and sustain their businesses.

Overcoming Barriers to Conventional Business Loans

Overcoming Barriers to Conventional Business Loans

Despite progress, women entrepreneurs often face challenges in accessing conventional business loans, partly due to lingering gender biases.

However, the rise of women-focused lending initiatives is changing this dynamic, offering more opportunities for female entrepreneurs.

Organizations like the Women’s Business Development Center (WBDC) provide targeted programs to help women overcome financial barriers.

By being prepared with a solid business plan, a healthy credit score, and potentially offering collateral, women can enhance their chances of securing the necessary funding.

Empowering Financial Decisions for Women Entrepreneurs

For women entrepreneurs navigating the business world in 2023, making empowered financial decisions is crucial.

This section provides guidance on managing finances smartly and leveraging opportunities for growth and stability.

Navigating The Wealth Gap

Women continue to face a significant wealth gap, earning on average 17% less than men.

Despite this challenge, there are strategies women can employ to fortify their finances.

Prioritizing retirement savings, like contributing to a 401(k) plan, and taking advantage of investment opportunities are key steps in building a stronger financial foundation.

Investment Strategies for Women

Investment Strategies for Women

Only 53% of women feel confident making investment decisions.

To overcome this, women entrepreneurs should take control of their investment accounts, understand their current asset allocation, and assess how it aligns with their goals.

Seeking educational resources or partnering with a fiduciary investment advisor can provide support in creating a diversified portfolio that reflects their investment objectives.

Supporting Female Entrepreneurship

Women entrepreneurs are making strides, with 49% of startups in 2021 being women-led. Investing in early-stage companies, particularly in sectors like technology and biotech, can be a way to support female entrepreneurship while diversifying one's investment portfolio.

Angel investor networks like Golden Seeds offer opportunities to invest in women-led businesses, contributing to economic growth and gender equity.

Advancing Financial Acumen In 2023

In 2023, for women entrepreneurs to successfully navigate the business terrain, advancing financial acumen is pivotal.

This section explores key strategies to enhance financial literacy and practical tips for effective financial management.

Embracing Financial Literacy and Investment Confidence

While women have made significant strides in the business world, a gap remains in financial literacy and investment confidence.

Women entrepreneurs need to take control of their financial futures by increasing their understanding of investments and financial planning.

This includes being informed about the current market trends, understanding the importance of diversifying investments, and considering non-traditional investment opportunities like commodities or real estate investment trusts.

Enhancing financial literacy not only empowers women in their personal financial management but also in making strategic decisions for their businesses.

Strategies For Wealth Building

Strategies For Wealth Building

Building wealth is a critical aspect of financial management, especially given the existing wealth gap between men and women.

Women entrepreneurs should focus on strategies such as maximizing contributions to retirement plans, exploring higher interest rate opportunities, and considering Roth IRA conversions during market downturns.

These approaches can help in accumulating wealth over time and ensuring financial stability in the future.

Supporting Women in Entrepreneurship

Supporting fellow women entrepreneurs is not just a social responsibility but also a smart financial strategy.

Investing in women-led startups, especially in sectors like technology and biotech, is a way to contribute to gender equity while diversifying one's investment portfolio.

Networks like Golden Seeds provide platforms for investing in women-led businesses, helping to close the gender gap in entrepreneurship and foster a more inclusive business ecosystem.

Final Remarks

As we move through 2023, it's clear that financial acumen is crucial for women entrepreneurs.

By enhancing financial literacy, focusing on wealth-building strategies, and supporting women-led ventures, women can overcome existing barriers and pave the way for a more equitable and prosperous business landscape.

The journey towards financial empowerment is ongoing, but with the right tools and a proactive approach, women entrepreneurs can navigate the complexities of the financial world and emerge as savvy, successful business leaders.

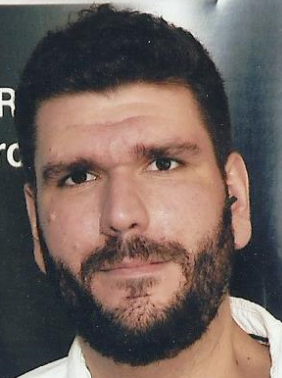

BIO:

BIO:

Darjan Kubik, holding a Bachelor's degree in English Language and Literature, is a fervent enthusiast in the realm of content creation. With a robust academic background in English, Darjan possesses a profound understanding of language nuances, narrative structures, and literary analysis. This expertise is channeled into a passion for creating compelling content across various platforms. Darjan's skill set extends beyond mere writing; it involves a deep appreciation of storytelling, an eye for detail, and a commitment to engaging audiences through creative and insightful content. Whether it's crafting written pieces, developing content strategies, or exploring new forms of digital storytelling, Darjan's approach is marked by a blend of literary proficiency and innovative thinking.