Smart Financial Moves: Monthly Dividend Stocks

In the realm of smart financial strategies, investing in monthly dividend stocks has emerged as an attractive option for enhancing business portfolios.

In the realm of smart financial strategies, investing in monthly dividend stocks has emerged as an attractive option for enhancing business portfolios.

These stocks, which distribute dividends every month, offer a consistent and predictable income stream.

This type of investment is particularly appealing in the current financial landscape, where traditional investment routes are experiencing shifts.

Monthly dividend stocks not only provide regular income but also serve as a potential hedge against market volatility.

Monthly Dividend Stocks

Monthly dividend stocks stand out in the investment world due to their unique payout structure.

Unlike traditional stocks that pay dividends quarterly or annually, these stocks provide shareholders with monthly income.

This regular cash flow can be particularly beneficial for investors seeking consistent income, such as retirees or those looking for a steady revenue stream to reinvest.

Finding Relevant Monthly Dividend Stocks

Finding Relevant Monthly Dividend Stocks

Identifying the right monthly dividend stocks for your portfolio requires a strategic approach.

The key is to focus on companies with strong fundamentals, a history of consistent dividend payments, and the potential for sustainable future growth.

Investors can find these stocks by researching online financial platforms, analyzing market trends, and keeping an eye on sectors that historically performed well in dividend payouts.

It's essential to diversify across various industries to mitigate risks associated with any single sector.

Highlighted Monthly Dividend Stocks

- Realty Income Corporation (O): This real estate investment trust focuses on commercial properties and has a long-standing record of consistent dividend payouts. As of early 2023, it declared its 631st consecutive monthly dividend, reflecting its strong performance and stability.

-

Stag Industrial (STAG): Specializing in industrial properties, STAG has a robust dividend history with monthly payouts. Its focus on eCommerce and industrial facilities positions it well in the current market.

Stag Industrial (STAG): Specializing in industrial properties, STAG has a robust dividend history with monthly payouts. Its focus on eCommerce and industrial facilities positions it well in the current market. - Main Street Capital (MAIN): Operating as a business development company, MAIN provides long-term debt and equity capital to lower-middle market companies. It has a notable history of monthly dividend distributions, making it an attractive option for investors seeking regular income.

- EPR Properties (EPR): This REIT invests in entertainment and leisure properties, including movie theaters and amusement parks. Despite facing challenges in 2022, it offers a substantial dividend yield with monthly distributions.

- LTC Properties (LTC): Focused on senior living communities and skilled nursing centers, LTC benefits from demographic trends like the aging baby boomer population. It also boasts a healthy dividend yield.

- PermRock Royalty Trust (PRT): Providing exposure to the oil and natural gas industries, PRT has shown impressive performance over the past year, with revenue growth and a notable dividend yield.

- Stellus Capital (SCM): SCM operates in venture debt financing, managing a significant asset base and maintaining strong relationships with borrowers. This positions it well for consistent dividend payments.

- Sabine Royalty (SBR): An investment in SBR offers exposure to the vast oil and gas space in the U.S., with the added benefit of non-taxable dividend distributions.

Each of these stocks presents a unique opportunity for investors, but it's crucial to conduct thorough research and consider factors like industry trends, company financials, and overall market conditions before making investment decisions.

Each of these stocks presents a unique opportunity for investors, but it's crucial to conduct thorough research and consider factors like industry trends, company financials, and overall market conditions before making investment decisions.

Diversifying across different sectors and companies can also help mitigate risks and enhance the stability of your investment portfolio.

Strategic Investing in Monthly Dividend Stocks

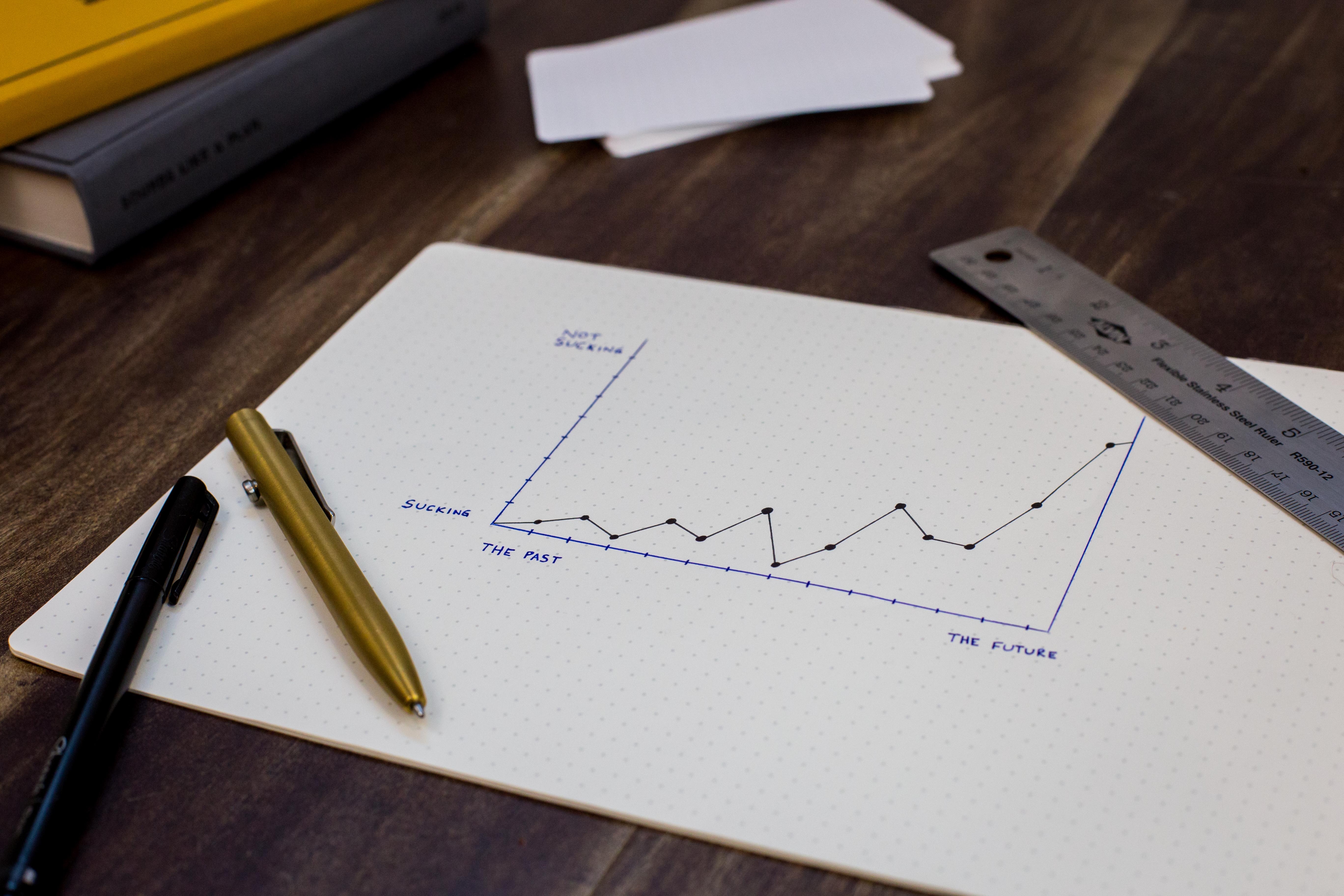

In the dynamic world of investing, monthly dividend stocks have carved a niche for themselves.

These stocks are not just about steady income; they're a strategic asset in a well-rounded portfolio.

The key to successful investment in monthly dividend stocks lies in understanding the nuances and employing effective strategies.

Key Strategies for Monthly Dividend Stock Investment

Investing in stocks that not only offer dividends but also demonstrate consistent dividend growth over time can yield significant returns.

A study by the Royal Bank of Canada highlighted that dividend growers have outperformed the S&P/TSX Composite Index with a compounded return of 11.7% over 30 years, compared to 6.6% for the Index.

This fact underscores the importance of choosing companies with stable and growing earnings, as they are more likely to sustain and increase their dividends.

Utilize Dividend Screeners

Utilize Dividend Screeners

Tools like Finviz and Dividend.com are invaluable for identifying promising dividend stocks.

These screeners allow you to filter stocks based on various criteria such as sector, dividend yield, payout ratio, and earnings per share growth.

For instance, you can search for technology stocks in Finviz with a dividend yield over 4% and a payout ratio below 80%.

Such targeted searches can help in creating a shortlist of potential investments.

Understand Dividend Dates

Knowing key dividend dates is crucial for timing your investments. These include the declaration date, ex-dividend date, record date, and payment date.

The ex-dividend date is particularly important because you must own the stock before this date to be eligible for the dividend.

Consider Monthly Dividend Stocks for Regular Income

While many companies pay dividends annually or quarterly, some offer monthly dividends.

This can be especially appealing if you're looking for a steady monthly income.

Although the list of such stocks isn't extensive, resources like Dividend.com's Monthly Dividend list can help identify them.

Invest in Dividend Aristocrats and Kings

Companies classified as Dividend Kings and Aristocrats are known for their long history of consistent dividend increases.

Dividend Kings have increased dividends for over 50 years, while Aristocrats have done so for over 25 years.

Investing in these companies, or in ETFs like ProShares NOBL that track Dividend Aristocrats, can be a wise strategy for long-term dividend growth.

Take a Contrarian View

For higher yields (6-8% or more), adopting a contrarian approach can be effective.

This involves looking beyond the general market consensus to find high-yield opportunities that may have been overlooked or undervalued due to broader market misjudgments.

Websites like Contrarian Outlook offer insights and recommendations for high-yield dividend investing.

Leverage Expert Resources

Services like Suredividend and Simplysafedividends offer tools and advice for setting up a dividend strategy focused on long-term, high-quality stocks.

They provide resources like newsletters, dividend investing courses, and tools that assess dividend safety scores for individual stocks.

Final Remarks

Investing in monthly dividend stocks offers a blend of steady income and strategic portfolio enhancement.

With careful selection based on company fundamentals, sector resilience, and dividend growth potential, these investments can be a reliable source of income.

Utilizing tools like dividend screeners, understanding crucial dividend dates, and considering monthly dividend stocks are key tactics.

Exploring Dividend Aristocrats and Kings, adopting a contrarian view, and leveraging resources like Suredividend and Simplysafedividends can further refine your strategy, making it a smart financial move in today's evolving investment landscape.

BIO:

BIO:

Darjan Kubik, holding a Bachelor's degree in English Language and Literature, is a fervent enthusiast in the realm of content creation. With a robust academic background in English, Darjan possesses a profound understanding of language nuances, narrative structures, and literary analysis. This expertise is channeled into a passion for creating compelling content across various platforms. Darjan's skill set extends beyond mere writing; it involves a deep appreciation of storytelling, an eye for detail, and a commitment to engaging audiences through creative and insightful content. Whether it's crafting written pieces, developing content strategies, or exploring new forms of digital storytelling, Darjan's approach is marked by a blend of literary proficiency and innovative thinking.